Your APR, regular payment and bank loan amount of money depend upon your credit score historical past and creditworthiness. To choose out a personal loan, lenders will perform a hard credit rating inquiry and request a full application, which could demand evidence of revenue, identity verification, evidence of handle and even more.

Get endless absolutely free credit history scores & reports Sign up for absolutely free credit rating checking get your absolutely free credit score score & report

Observe that this lender charges origination charges together with expenses for late and returned payments, all of which might enhance your All round borrowing expenses.

You sometimes will need good to outstanding credit — typically that means a credit history rating of at the very least 670 — to have accredited for a private loan. However, you could qualify with Improve having a credit rating rating as low as 580, which could enable it to be a really perfect possibility if you have bad credit history.

A HELOC is secured by your house, and the amount you are able to borrow is really a part of your property’s worth minus the amount left to pay for around the mortgage loan. It usually usually takes a number of weeks to qualify for your HELOC, but if you have already got just one open, you may draw from it everytime you want to acquire a identical-day mortgage.

The early payday application is a whole new variation on on-line cash improvements. These apps supply a cheaper and in some instances, no-Price tag alternate to payday lending. Approval is predicated Pretty much solely in your paycheck And just how cash flows in and out of your banking account.

Calendar 3 Yrs of knowledge Pippin Wilbers is a Bankrate editor specializing in more info personalized and auto financial loans. Pippin is enthusiastic about demystifying complex matters, like motor vehicle funding, and aiding borrowers not sleep-to-day in the modifying and difficult borrower ecosystem. Read extra Link with Pippin Wilbers on LinkedIn

Please Understand that while some delivers could come from WalletHub promoting associates, sponsorship position performed no position in bank loan range.

You’ll will need to apply somewhere that gives the chance of exact same-working day funding. LightStream and Alliant CU are great places to get started on.

Your curiosity fee performs A serious portion in determining your In general borrowing expenses. Interest rates on own loans can vary from under six% to 36%, depending upon the lender along with other variables like your credit rating and repayment phrase.

In case you have a bank card, find out if you may get a cash advance. Most credit cards offer you a short-term cash progress possibility. You received’t really have to open up a whole new account and should even have the capacity to obtain the cash at an area ATM.

Although superior borrowing restrictions may be valuable to protect substantial purchases, you may only will need use of a small quantity of cash. In this instance, a small personalized financial loan can be a excellent possibility. This kind of bank loan can also enable you to borrow only what you may need and keep away from paying out added interest and fees.

If you need to get cash right away, one among your best choices would be to ask somebody you understand to Allow you to borrow it. That way, you won’t really have to experience any type of elaborate acceptance method.

Continue to, there are important disadvantages to think about. These financial loans are high priced and feature brief repayment durations that may result in a vicious cycle of financial debt. They ought to only be utilized as A final vacation resort. Rather, contemplate additional economical alternatives.

Alicia Silverstone Then & Now!

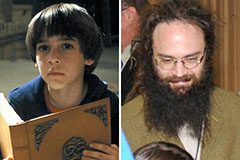

Alicia Silverstone Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!